Conferences and Events in Our Modern Pandemic

Aug 13, 2020

Estimated Reading Time: 32 Mins

Main Findings of This Article:

- Conference organizers of virtual conferences can no longer solidly promise to sponsors a defined return on their conference spend investment as they would have been able to with physical conferences

- Virtual conferences have in a sense, become like Over the Counter (OTC) Penny Stocks. By that I mean, they are highly risky, they do offer some possibilities for a high return, but they are essentially no where near the solid investments that physical conferences were.

- It is unknown at this time when things will change in terms of the public’s risk perception and willingness to engage in physical conferences again

- A new risk model for conferences may be built which applies across many new ongoing digital marketing activities - this new way of thinking may provide opportunities for building future success in the virtual event space.

Table of Contents

- Main Findings of This Article:

- Where We Are Today

- My Background and Why I’m Writing This Article

- The Mechanisms of Viral Spread

- An Enhanced Pandemic in a Technologically Enhanced World

- Past Performance Does Not Guarantee Future Results

- Reframing the Scenario We Are In

- The Business Model of Conferences

- Longer Term Projections on Conference industry

- Conclusion

Where We Are Today

The $100 billion world of conferences and events has been without a doubt, completely devastated by COVID19. The losses from the string of tech conference cancellations from earlier this year have likely climbed up into the tens of billions of dollars at this point, with some of the world’s largest conferences being continuously postponed, cancelled or converted to virtual events.

The business model behind events and conferences - bringing people together for serendipitous meetings - represents the perfect breeding ground for viral spread, along with other similar, “mass gathering” type industries including large sporting events, concerts, large indoor facilities such as malls or indoor theme parks, movie theaters, restaurants and so on.

My Background and Why I’m Writing This Article

COVID19 or rather the public health response to the virus, has affected my business and life greatly, as I run a company called Knowledge Conferences and a nationally recognized conference called IoTFuse. While I have not yet been infected with COVID19, nor has anyone I know well yet died from the virus, I have had several friends and professional contacts contract it, and some of whom have had family members die from it. I am sure that as time goes on, sadly, this number will go up for many of us around the globe. I converted my conference into a completely virtual event, in April 2020, when it was scheduled to take place. This pandemic inspired digital transformation was perhaps the singular most harrowing experience of my professional life, and I will talk more about what happened in a future post, but the purpose of this post is to really dig deep into the environment under which we are all operating now.

Conferences and events play an important role in society. Much like restaurants, which have been devastated as well, conferences and events represent excellent entry-level jobs, and the job outlook for this sector had been projected to grow around 7% between 2018 and 2028, according to the US BLS. Much like restaurant jobs have been termed as providing a social safety net for much of US Society in terms of being a job source that anyone can jump into in dire situations, conferences and tech conferences in particular have represented a step or rung on a ladder for many young professionals or underrepresented professionals to get themselves going on a career path, either by speaking at, working for or organizing a conference around an important topic. Event planning has represented a fairly decent paying job at around $40,000 to $60,000 depending upon location, for those without a high amount of expertise or education in a sector. Tech conferences, or at least quality independent conferences, essentially neutral ground for various tech topics, have created ways for industry to flourish and explore, safe spaces for serendipitous meetings and exploratory activities which represent low cost research and development that goes uncounted and off the books of private or public companies around the world, while at the same time providing upwards of half of marketing qualified lead generation activities for service providers. In short, conference organizers have largely been the, “salt of the earth,” of the tech world, providing greater velocity of knowledge transference, while not necessarily having had to originate from purely technical educational backgrounds or roles.

That being said - holding conferences and mass gatherings for the time being, represents a large public risk. In this blog post, I would like to take a hard headed approach to this analysis of the Conference and Events industry. I have noticed over the past several months an emerging pattern in the world of tech conferences marked by overpromises, unrealistic objectives and even downright fraud.

My essay will go through several sections, to try to do the best possible job of investigating a range of possible outcomes for the industry:

- Mechanisms of how coronaviruses spread, and in particular what is known about COVID19

- Brief historical analysis of the previous large-scale pandemic in 1918,

- Project a range of possibilities for the near future,

- Brief overview of the business model behind tech conferences and events,

- Possible ramifications for the far future of conferences and events.

Part of why I have an interest in taking a hard-headed approach to understand a variety of possibilities of what may happen comes from my career, during the last economic crisis. In 2008 and 2009 I worked as an optical engineer and image recognition software developer in the film and class industry, and one of my former bosses told me regarding the prediction of future trends relying on scientific phenomena, “if the business can’t be backed by the fundamental physics, it’s a scam.” He was referring to the company, “Nanosolar” which he called, “Scamosolar.” Nanosolar in 2009 had received over $100 million dollars in venture funding, but my boss was insistent that it was essentially a case of physicists claiming to financiers who didn’t know any better, that they would be able to coat plastic with extremely precise, multi-micron thick layers of chemicals on plastic roll to roll sheets to manufacture solar panels which would be orders of magnitude cheaper than existing forms. Of course Scamosolar did in fact, go defunct, because physics dictate that you can never really pull plastic sheets taught enough between rollers at micron precision. I suppose a modified version of what my boss told me would be, which is the hypothesis of this blog post is that, “If the business can’t be backed by the fundamental biology, it’s a scam.”

The Mechanisms of Viral Spread

At the time of writing this blog post, the world has gone through about eight months of observing generally how COVID19 spreads, however there have been stringent interventions and changes in human behavior which have perhaps left a lot of us scratching our heads and wondering what the precise mechanisms are behind how the virus spreads, what is known and what is not known since the virus first popped up in popular conciseness. The average person today may take for granted that we now generally know how the virus spreads based upon what we have been directed to do in terms of washing our hands, wearing masks and so fourth. However there is continuous and changing scientific and medical consensus based upon new ongoing studies since the virus first emerged. One unresolved topic, on which it appears that evidence is still preliminary and requires further assessment, is the question of whether the virus spreads through just droplets, which is known and widely agreed upon, but aerosols, or “airborne spread” in addition to those droplets.

The United States Centers for Disease Control (CDC) States:

“The virus that causes COVID-19 is thought to spread mainly from person to person, mainly through respiratory droplets produced when an infected person coughs, sneezes, or talks. These droplets can land in the mouths or noses of people who are nearby or possibly be inhaled into the lungs. Spread is more likely when people are in close contact with one another (within about 6 feet).”

This statement is very direct about referring to what is widely agreed upon, that COVID19 spreads through droplet spread, as opposed to aerosol spread. However the World Health Organization (WHO) goes a bit further in addressing aerosol spread:

“Some medical procedures can produce very small droplets (called aerosolized droplet nuclei or aerosols) that are able to stay suspended in the air for longer periods of time. When such medical procedures are conducted on people infected with COVID-19 in health facilities, these aerosols can contain the COVID-19 virus. These aerosols may potentially be inhaled by others if they are not wearing appropriate personal protective equipment. Therefore, it is essential that all health workers performing these medical procedures take specific airborne protection measures, including using appropriate personal protective equipment. Visitors should not be permitted in areas where such medical procedures are being performed.”

The WHO further goes on to state on this same page:

“There have been reported outbreaks of COVID-19 in some closed settings, such as restaurants, nightclubs, places of worship or places of work where people may be shouting, talking, or singing. In these outbreaks, aerosol transmission, particularly in these indoor locations where there are crowded and inadequately ventilated spaces where infected persons spend long periods of time with others, cannot be ruled out. More studies are urgently needed to investigate such instances and assess their significance for transmission of COVID-19.”

On the surface, the difference between aerosol or airborne spread sounds stark, and the ramifications of each type of spread mechanism for the conference world could be massive. Since the WHO is saying that aerosol spread can’t be ruled out, let’s take a look at what the difference between aerosol spread and droplet spread means:

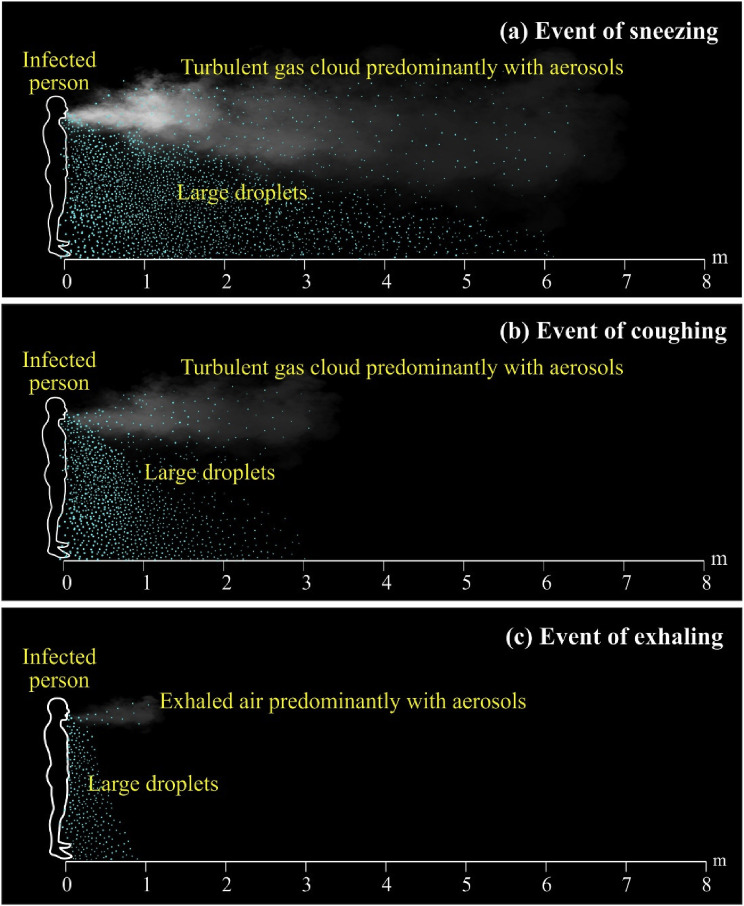

Image source National Institutes of Health Paper.

Essentially, from a reading of this National Institutes of Health paper, there is no clear standard size cutoff between a droplet and aerosol, and there is not a globally precise definition of an aerosol vs. a droplet, but rather they are defined as needed, however there are some common size ranges (1 to 5 micrometers for aerosols) that have been used across similar studies. The main important point is to be able to study and predict spread in different environments, and come up with clear public health recommendations based upon empirical data.

Conferences are all about talking and meeting others. We may have ways of creating forms of, “security theater,” which essentially addresses a low-level understanding of how to prevent biological spread. We may invest in hand washing stations, plexiglas barriers, masks, and any other manner of protective measures, but as of now, we don’t know if the simple act of talking may actually lead to the spread of COVID19 in an enclosed setting. Talking releases anywhere from a few dozen to a few hundred droplets and aerosols ranging in size from 1 to 100 microns in size, and includes mostly aerosols ranging in size from 1 to 2 micrometer. For that matter, sneezing can produce anywhere from a few hundred thousand to a few million droplets and aerosols, mostly in the aerosol size range. That one guy (or gal) sitting thirty feet away at a conference who lets out a sneeze, who happens to be infected with COVID19 yet asymptomatic, could end up infecting hundreds of people in an enclosed space with a single sneeze.

An Enhanced Pandemic in a Technologically Enhanced World

There are perhaps few precedents in any other point in history where a set of industries has been faced with such severe devastation. One might look at the previous large pandemic, the influenza virus from 1918-1920 - but that pandemic just doesn’t quite compare for a few reasons. For one thing, the world population has since then increased by 2800%, and beyond that we as a species have achieved massive transformations in our our public transportation infrastructure, global communications speed, forecasting capability as well as knowledge about what drives infectious transmission.

Basically the “step function,” of the COVID19 happening and then the public and government bodies reacting does not look like the 1918 pandemic at all. During the previous global pandemic, there was a much slower reaction speed. There was less understanding about how to prevent the disease and how it transmitted - James Watson and Francis Crick had not yet discovered the genome. Arguably we as a species, at least in my locale, the Twin Cities of Minnesota have reacted much more efficiently during the COVID19 pandemic than the 1918 Influenza Pandemic. In addition to the general lack of know-how during the pandemic over a century ago, the Twin Cities lacked nurses and doctors in 1918, because a lot of them were deployed in World War 1. This National Institutes of Health study goes through how Minneapolis and St. Paul reacted to the initial stages of the 1918 Influenza pandemic - there was considerable confusion about how many underlying cases may have already existed by the time Minnesotan authorities gained awareness that the flu virus was even there. Within the first 10 days of the Pandemic starting on September 30th, 1918, the count of hospitalized cases went from 1 to over 800. Compare that to the COVID19 pandemic, where the number of positive cases detected went from 1 to 90 from March 5th, 2020 to March 15th, 2020. As far as hospitalizations in Minnesota go, the Minnesota Department of Health shows that hospitalizations data went from 1 to 75 from March 19th, 2020 to March 29th, 2020. From my understanding, much of how the nation as a whole during COVID19, has in fact acted with a far better response than we did in 1918, contrary to popular belief. However, some of the same strengths that we now have in terms of communication efficiency have lead to weaknesses. Whereas we now have the capability to more effectively study and disseminate information about the virus, leading to superior response times and methods, we also unfortunately are experiencing a much faster proliferation of misinformation. Where much of the same pattern of denialism, lack of solutions and blaming did occur during the 1918 pandemic, what we appear to be experiencing now is a fractalization of information streams. Whereas in 1918, there were fewer information authorities, meaning the public looked to a narrower set of information sources to determine how to act, today with the web, we are experiencing many competing clusters of information authorities, coming competing interests originating in political, religious, professional, or national influences and being disseminated by discussion boards, social media, online video, traditional media or even just some unimportant blogger like myself. This has resulted in a truly what one might term, “An Enhanced Pandemic in a Technologically Enhanced World.”

None of this is of course to diminish the current pandemic in any way, or suggest that we are on, “the right track and that things will be fine,” but rather to show that there are stark differences between how the two events unfolded, and that we cannot simply look to the 1918 influenza pandemic as a predictor for how things may play out during the current pandemic.

Past Performance Does Not Guarantee Future Results

I believe that it is important to point all of this out because there seems to be a dominant belief in industry at this time that the previous pandemic will be demonstrative of what will happen this time around. However, arguably this is not really a 100-year event, like a 100-year flood, or history repeating itself, this is a flavor of viral-economic calamity that has never happened before, period.

This pandemic has sliced across a specific set of industries, hobbling the economy as a whole by shooting part of it in the leg. The only analog which is comparable is likely a single country experiencing a massive natural disaster, war or invasion. However even in those cases, the industry disruption tends to be short-lived, rather than semi-permanent. There is absolutely no concrete indicator that we have on our hands at the time of writing this article which will allow humanity to safely scale up large events at a known date. While it is possible that a vaccine may be developed over the coming months or years - at this point, it is unknown when that may occur, or even if that may occur. Public infectious disease experts seem to be in agreement that vaccines should not be considered not be a silver bullet for allowing mass activity, and that even if a vaccine is developed within the shortest timeframe known to human history, COVID19 may be with us for a very long time, and it may be that we need to adapt society in ways we perhaps did not consider at the onset of this disease.

Reframing the Scenario We Are In

The typical model that I believe sitting in most people’s mind at this time is that, “things will generally get better.” As an industry, and perhaps even the world at large have been referring to what is going on as a, “crisis,” a word which signifies that a story will be written which includes a defined beginning, middle and end, within a perhaps month long or multi-month long time period. Instead what we may be faced with, is a variety of different risk scenarios defined by possible vaccination timeframes and effectiveness, as well as continuously developing human risk assessment of the seriousness of virus situation. In short, we really don’t know what’s going to happen, and a continuous appraisal of the situation on a monthly or even weekly basis is probably what is warranted, rather than a long-term, multi-month prediction.

This becomes incredibly important in the event industry in particular, where the fundamental requirement for holding a mass gathering event, besides of course the attendees, is a physical space. Physical spaces typically need to be reserved many months in advance, if not over a year in advance. I believe that the event industry, based upon its legacy operating procedures and just how events get financed, has in many cases opted mostly toward postponing or, “punting” events to take place at a future date, perhaps a year in the future. However a closer consideration of the state of the world shows that many events may not take place for a very long time, if at all, depending upon what happens.

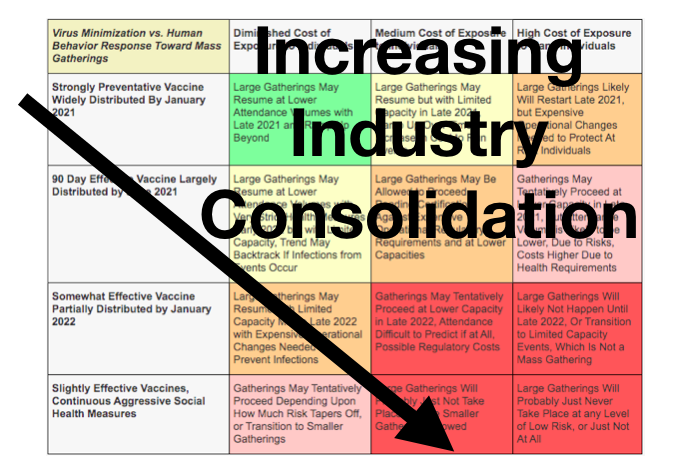

Below, I have created a scenario matrix outlining possible scenarios in terms of vaccine development vs. human behavior in the face of various perceptions of risk. Within the cells of the matrix, I have written common sense outcomes based upon the scenarios outlined on the different axes.

Conference Industry Scenario Matrix

| Virus Minimization vs. Human Behavior Response Toward Mass Gatherings | Diminished Cost of Exposure to Individuals | Medium Cost of Exposure to Individuals | High Cost of Exposure to Many Individuals |

|---|---|---|---|

| Strongly Preventative Vaccine Widely Distributed By January 2021 |

Large Gatherings May Resume at Lower Attendance Volumes with Late 2021 and Ramp Up Beyond | Large Gatherings May Resume but with Limited Capacity in Late 2021, Ramp Up Over Time. Increase in Cost to Run Events. | Large Gatherings Likely Will Restart Late 2021, but Expensive Operational Changes Needed to Protect At Risk Individuals |

| 90 Day Effective Vaccine Largely Distributed by June 2021 | Large Gatherings May Resume at Lower Attendance Volumes with Very Strict Health Measures Early 2022 but with Limited Capacity, Trend May Backtrack If Infections from Events Occur | Large Gatherings May Be Allowed to Proceed Pending Certification Against Expensive Operational Regulatory Requirements and at Lower Capacities | Gatherings May Tentatively Proceed at Lower Capacity in Late 2021, But Attendance Volume is Likely to be Lower, Due to Risks, Costs Higher Due to Health Requirements |

| Somewhat Effective Vaccine Partially Distributed by January 2022 | Large Gatherings May Resume with Limited Capacity Mid to Late 2022 with Expensive Operational Changes Needed to Prevent Infections | Gatherings May Tentatively Proceed at Lower Capacity in Late 2022, Attendance Difficult to Predict if at All, Possible Regulatory Costs | Large Gatherings Will Likely Not Happen Until Late 2022, Or Transition to Limited Capacity Events, Which Is Not a Mass Gathering |

| Slightly Effective Vaccines, Continuous Aggressive Social Health Measures | Gatherings May Tentatively Proceed Depending Upon How Much Risk Tapers Off, or Transition to Smaller Gatherings | Large Gatherings Will Probably Just Not Take Place, Maybe Smaller Gatherings Allowed | Large Gatherings Will Probably Just Never Take Place at any Level of Low Risk, or Just Not At All |

To summarize the above table, the farther to the right and below that we go in terms of both health risks to individual customers, longer timelines and lower effectiveness of solutions, the worse outcome for the industry in terms of previous business models. This table represents a, “risk model,” approach to where things could go in terms of the conference industry, rather than making a definitive prediction. Multiple scenarios could arise in the coming months and years, depending upon where science leads us, and what more we learn about COVID19. For example, over the last month it has become increasingly clear that while the death rate of those infected with COVID19 in the US has hovered around 1% to 2% as a large overall average, affecting older populations at a greater rate the effects of, “Long COVID”, or health affects as a result of contracting COVID19, including brain fog, lung damage, heart damage and hypertension, are largely still unknown in terms of severity or how long these effects may last.

What The Market Has Looked Like in 2020

Virtual events are largely still in their infancy, but some of the weaknesses of virtual events are definitely showing through. In a post titled, Rethinking Community Knowledge Worker Development, I will go through some of the user experience factors behind what has been driving massive variations in attendance levels, and in particular, lack of willingness to participate, and differences in ways that attendees participate in virtual events as opposed to physical events, but for now I will just segment virtual event types into three main types. I don’t have statistics on how many events of each type are occuring right now, but rest assured, I have personally found and analyzed events that are fraudulently reporting their virtual attendance numbers by looking at their Alexa web traffic ranking, and have heard from sponsors and previous sponsors of mine of an event that had reported to have over 100,000 attendees signed up, and instead had attendance in the low hundreds.

| Virtual Conference Classifications - Post-COVID19 | ||

|---|---|---|

| Virtual Conference Type | What Happened | Why This Happened |

| Hyperinflation | Highly reported attendee numbers, attendance much lower than reported. | Not enough time to transition to virtual conference, not properly marketed, and people's general unwillingness to convert to virtual. There may have been a variety of both marketing factors and promotional factors at play, the conference material may not have ever been extremely interesting to the attendees in the physical realm in the past, but face to face networking and socializing at the physical conference may have been a large benefit. |

| The Engager | Conference expectations for virtual conference managed, not much in the way of attendance but some marketing objectives possibly met for sponsors. | Conference may have already had sufficient momentum to convince community members to attend, may be an ongoing yearly tradition with a lot of emotional attachment, so attendees are at least partially willing to engage or tune in for a bit. The conference may have used sufficient technology to allow networking or some kind of peripheral benefit to attendees. |

| Gold Rush | Attendance much higher than physical conferences previously, interest levels through the roof - incredible success. | There have been very few, but have existed instances of conferences which seem to have hit at the right time, due to all of the transitions which have been going on - becoming extremely relevant during the time they were held. For example, there was a food safety and security conference which was already scheduled to take place during the time when there were food shortages and the national conversation began to turn to food. This conference had formally been a regularly attended but not out-of-this-world conference in previous years, but in 2020 was attended far beyond where it had been previously because of the digital venue creating increased accessibility, and the topic matter being extremely relevant. |

The Business Model of Conferences

Types of Large Conferences

Large Consolidated Expo

Many Large Consolidated Expo companies have their origins in news, namely financial and stock trading informational markets. In the past, large publishing companies, which may have started as far back as the 1800’s, got into the business of putting together conferences, or acquired conferences (or companies that held conferences). These large scale conference companies may be extremely large scale private companies, or even public companies such as Informa. These companies, being public, may have access to bonds and loans specifically for the purposes of running expos that other type of conferences may not, simply because they have a many decade track record of successfully running profitable conferences, and have a large diversified portfolio of conferences.

Corporate Events

Corporate Events are essentially a company running an event for perhaps some of the same purpose why they may also attend an event, but rather than merely attending, they are branding the event and using it as a marketing outlet. In these scenarios, the purpose of the event may not even be to make a profit, but rather to be a, “loss leader” for other products and services, or to break even in order to add value to vendors, partners and customers.

Community Conferences

Community Conferences are the small businesses of the conference world - these could be started by anyone, for any purpose, and may range in size from a company or non-profit event that has grown in size over a decade to include thousands of attendees, to perhaps just a group of 100 or so people who are interested in a particular software. These community conferences may be businesses in it of themselves, like the Large Consolidated Expos discussed above, or they may serve as some kind of loss leader or marketing generation vehicle for a group of folks, service providers, or small companies - or they may be simply run for passion reasons, or for some combination. These are the, “entrepreneurs,” which provide spice and diversity of thought into the information transference that goes on in the world of conferences. Larger consolidated companies may not be willing to take risks starting up a conference on a niche topic, but smaller conferences do it all the time.

The Basic P and L Statement

Regardless of what type of conference being run, the Profit and Loss Statement of a physical conference which may have occured in the, “old world” prior to the COVID19 pandemic can be simplified as follows:

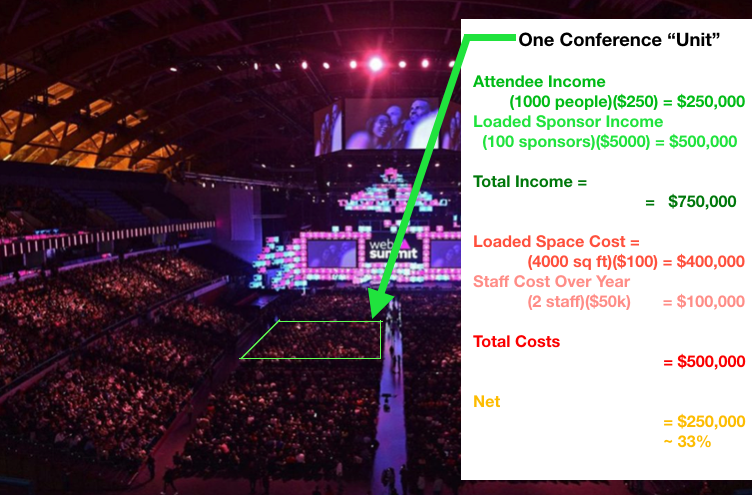

Often larger expos and conferences may model out their business model as square footage rather than as, “Conference Units,” as I have termed above in this example. Conference Units are meant to demonstrate simply that there are similar sets of activities and resources across all different categories of conferences, whether they be large consolidated events or public companies, corporate events or community events.

| Conference Unit Profit and Loss | ||

|---|---|---|

| Attendee Ticket Sale Income | $250,000 | |

| Sponsor Income | $500,000 | |

| Total Income | $750,000 | |

| Loaded Space Cost | $250,000 | |

| Staff and Setup Costs Over Year | $250,000 | |

| Total Costs | $500,000 | |

| Net | $250,000 | |

| Net Percentage of Sales | ~33% | |

The above model is farily generalized and this will of course vary from conference to conference, and among the conference types. However, generally if you compare the net margins before interest and taxes of conference companies to parallel industries such as restaurants and hospitality, the general benchmark for higher end hospitality is around 20% to 30%, and conferences are in a sense, a high-end hospitality function mixed with marketing. Hence a generalized business model of about 1/3rd net revenue before interest and taxes for a, “Conference Unit” is generally acceptable.

Sponsor Considerations - Financing Conferences

In most cases, conferences are going to have sponsors of some type. While conferences may be also run completely on attendee revenue, this is a much risker way of running a conference, because you have to wait until tickets are sold to be able to know for sure that the conference is going to be able to cover its bills. Human ticket buying nature dictates that 80% of the tickets purchased for a physical conference do not occur until the last couple of weeks prior to the date of the conference. Conferences which run 100% on ticket revenue have opportunities to build much more attendee-focused experiences, and buy in from the community, but suffer from market effects.

It is important to consider how sponsors think about conferences, since sponsorship revenue may actually drive a significant amount of conference activity.

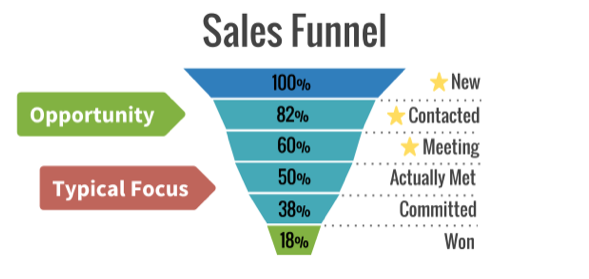

Typically it is the marketing department of an organization which spends money on sponsorships. In many companies, it is marketing’s job to support sales, particularly if that company has an actual sales force. Of course this will vary from company to company and industry to industry, but generally holds true. Essentially, the marketing department, by sponsoring a conference, is supporting the sales department by filling the sales funnel, and of course assisting sales personnel in moving contacts and leads down an existing pipeline by building face to face trust.

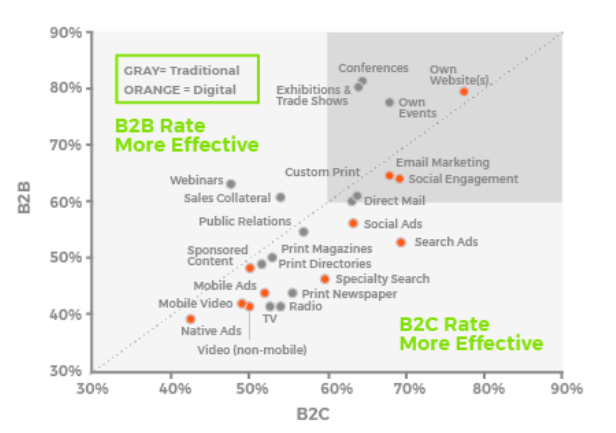

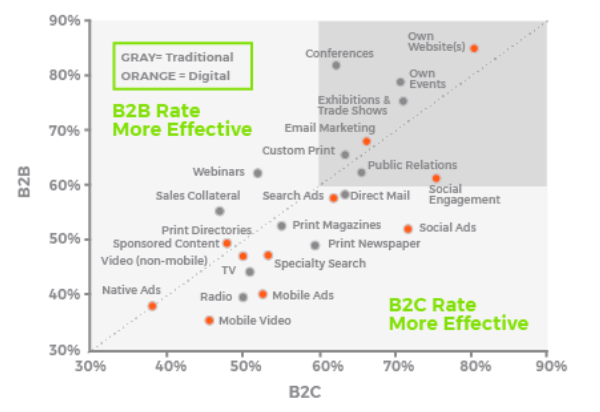

Marketers choose to invest in a conference among a broad array of market engagement opportunities. While some companies depend upon conferences much more than others, Marketing Directors do not make their decisions in a vacuum. They are typically looking at their entire sales and marketing funnel, and comparing the effectiveness rates across many different marketing opportunities which includes conferences and expos. As you can see in the below chart, which draws off of survey data from over 13,000 marketers over 10 years from a public relations firm, average rates for marketing effectiveness differ depending upon the channel used.

Lead Generation Effectiveness for Various Activities

Brand Building Effectiveness for Various Activities

Source: White Paper from Public Relations firm Cision

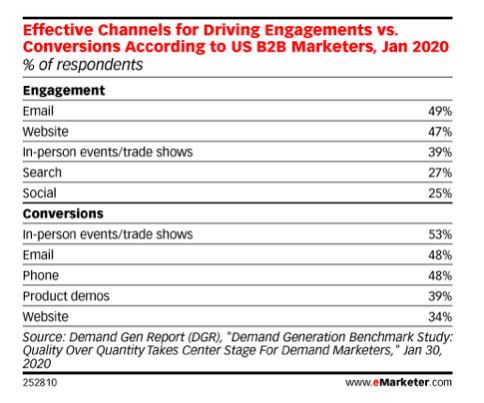

In addition to the, “overall effectiveness” of a given channel, marketing directors may also look at raw engagement vs. conversion rates for a particular channel strategy, and compare them to each other. The below chart shows a survey of B2B marketing directors and their findings on effectiveness of different channels as of January 2020, immediately prior to the COVID19 pandemic.

Source: Marketer.com

Basically, sponsors do not sponsor physical shows, “out of the goodness of their heart,” they do so because it supports ongoing sales activities. Going forward in our new socially distant world, it may be reasonable to speculate that the conversion rate of virtual events may be significantly lower than in-person trade shows and events, perhaps more in line with what one might see on a website conversion rate.

Conference Sponsor Return on Investment

When marketing directors narrow things down and compare conferences to one another, they typically may look at the number of, “Marketing Qualified Leads,” that came out of a conference, which may be measured by engaged meetings.

| Conference Engagement Rates | |

|---|---|

| Number of Engaged Prospects | Pe |

| Number of Passing Prospects | Pp |

| Marketing Effectiveness Percentage | = Pe/Pp |

| Overall Sponsorship Costs | |

| Sponsorship Cost | $5,000 |

| Other Costs - Flight, Hotel, Staff Time | $5,000 |

| Total Costs | $10,000 |

| Cost Per Engaged Face to Face Meeting | |

| Engaged Face to Face Meeting Cost | $10,000/Pe |

| Engaged Face to Face Meeting Range | $50 to $200 |

In summary, a marketing director may, at the end of the day, try to understand the cost of getting a salesperson into a meeting, based upon all marketing spend, and then try to optimize that cost on a quarterly or yearly basis by investing in:

- The right marketing channels.

- The right conferences, if conferences are the right channel.

The Work Involved in Put a Conference Together

Putting together a conference is a lot of work, and in our idealized model above, the staff and other costs, or the, “behind the scenes,” represents upwards of 50% or more of the costs throughout the year of organizing a physical conference. Below is a high level list of all of the major tasks involved in making a conference work.

| Staff and Setup Conference Activities |

|---|

| Sponsorship Sales |

| Marketing, Emails, Social Media |

| Website (Hosting, Maintain, Content) & Software Selection - for Layout, Communication, Etc. |

| Graphic Design, Design |

| Purchasing, Logistics, Technical Setup |

| Inviting Speakers, Managing Speaker Communications |

| Attendee Customer Service |

| Building the Conference Program, Managing Speaker Times, Themes, Content |

| Financial Accounting |

| Venue Relations, Purchasing, Negotiation |

| Timelines, Project Management |

In summary:

- Events are often financed through pulling together a critical number of sponsors. Without these sponsors, events cannot happen.

- Events also bring in attendees, which obviously are needed to run a conference, but depending upon the event, the attendees may pay anywhere from nothing to thousands of dollars per attendee to attend, which may range from 0 to 2/3rds of a conference financing, but the higher the dependency on purely attendee revenue, the greater the financial risk as space and staff time is generally much more fixed.

- Sponsors decide whether and how to engage with events based upon their internal calculations for engagement rates, or conversion rates. Companies which have a heavy sales strategy and conversion strategy may invest more heavily in conferences, but may also measure conferences against each other with a clearer degree of certainty than companies looking for brand establishment and recognition.

Risk Models When Transitioning To Digital Events

To attempt to predict how virtual conference sector may operate going forward, I would propose a risk based model which takes into account the generalized conference business model discussed in this article and the classifications of virtual events that we have seen in actuality, including, “Hyperinflation,” “the Engager,” and “the Gold Rush,” mentioned above in this article.

- Attendance at virtual conferences is known to vary considerably, and may generally be lower and less engaged than physical events. There is no captive audience, attendees float in and float out, like ghosts, and as such this means that conference organizers can no longer solidly promise to sponsors a defined return on their conference spend investment.

- On the conference side, one of the inherent risks in transitioning an event organization or company into a digital event company, is first off that staff and setup (promotional) costs may be somewhat similar, depending upon staff running event. As discussed above, much of the cost of running the event is based upon the marketing and gathering of speakers, getting attendees engaged with websites and communication, as well as garnering sponsorships. Without any other serious operational changes, this labor rate could remain fixed between physical conferences and virtual conferences.

- Event space costs, food, purchasing, is all but non-existent. However in its place, software costs, website costs, the costs of backing up systems and ensuring that all of the proper accounts are in place to make sure the event does not fail from a technical perspective, have gone up considerably.

- In many cases, the type of people who may have previously been involved in running a conference and organizing physical activities, shipping, may not have a lot of familiarity with running virtual events right out of the gate, so there is a huge risk of mistakes and errors or just not knowing what to do at all, which is probably part of the reason why a lot of conferences just outright cancelled during COVID19 rather than even attempt proceeding in a digital format.

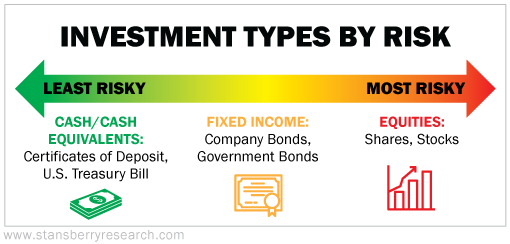

What all of this leads up to, is that virtual conferences, at least for the time being have become highly expensive, yet highly risky assets. Virtual conferences have in a sense, become like Over the Counter (OTC) Penny Stocks. By that I mean, they are highly risky, they do offer some possibilities for a high return, but they are essentially no where near the solid investments that physical conferences were.

Per the, “Investment Risk Model” image above, prior to the COVID19 pandemic, conferences were the high yield bond of the marketing world. They were expensive, but they offered a solid return on investment. Now with so many industries being thrust into the digital world, we no longer have as much capacity to simply purchase that trusted, face-to-face value building which so many industries have run on and leveraged to grow and function.

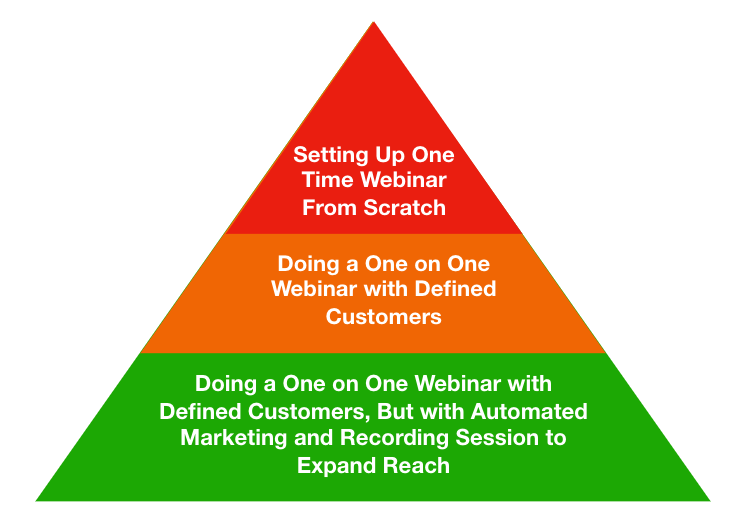

A new risk model for conferences may be built which applies across many new ongoing digital marketing activities - this new way of thinking may provide opportunities for building future success in the virtual event space. Imagine for example that you are a marketing director, tasked with putting on a webinar. What’s the risk profile of doing that webinar? You will need to be able to answer to other team members, as well as whoever allocates the budget above you, why this webinar is worth it to run, and report engagement vs. spend metrics.

- One way to set this webinar up would be to just set it up from scratch, and start pumping it out into email lists and social media, basically the, “if you build it they will come,” model. This model may be lower cost, but if it pulls off well and becomes a, “Gold Rush,” you created an extremely valuable penny stock.

- Another way to do this, which perhaps lowers the, “risk” of engagement would be perhaps to set up a webinar with a defined set of customers who you already have in place, and then hopefully invite in some newer or earlier customers. This would allow you to create a clearer immediate return on investment by engaging with defined customers, assuming they have the time to attend, but also to possibly convert over new customers.

- Finally, you could also hypothetically start up a collection of webinars, working with a team of vendors, partners, customers and providers to set up a variety of content which collectively casts a wide net of topic matter, further ensuring that your singular webinar may be more successful through network effects. You could still invite your customers as shown in the previous model, but you are also using network marketing to ideally pull in more customers, rather than pure social media or email spend.

Longer Term Projections on Conference industry

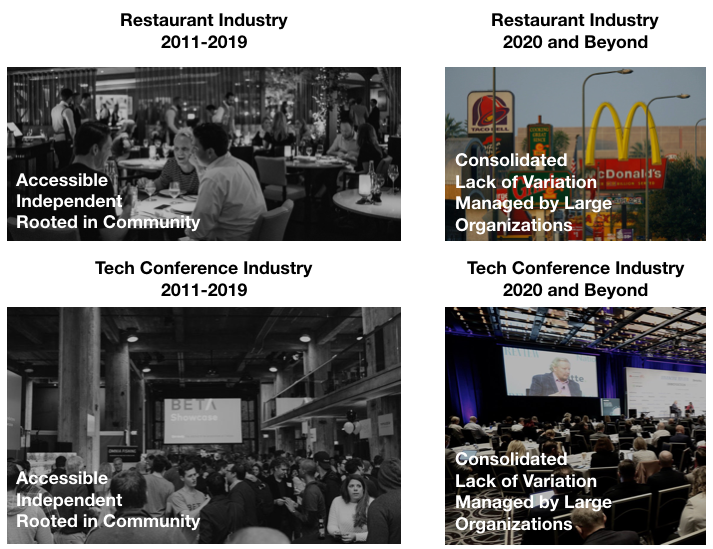

Sadly, as with any major disruption, there will be companies which fail to adapt and in particular, conferences and events which we know and love which will no longer be able to function. This is an inevitable outcome of the situation we are in - it’s just a matter of timeframes, severity and conference business models before we know which ones will be able to survive.

I am reminded of an article I had read about how COVID19 has put the restaurant industry at the mercy of the tech industry. In it the author Sarah Emerson makes a poignant observation:

But the cost of techno-optimized restaurants could be the disappearance of beloved neighborhood eateries — by empowering delivery apps that demand near-impossible fees, and weakening the need for brick-and-mortar establishments that, while challenging to run even in a healthy economy, are embedded in the fabric of so many local communities.

Just as we see neighborhood restaurants close in favor of chain stores, and we see the small shut their doors in favor of the large, at least in the, “medium term,” next decade timeframe, we may enter into a period of blight in the conference world, where only the largest entities and corporate events may be able to flourish and return, because of their access to low interest financing and capability to work in more highly regulated or health-intensive environments when the opening does eventually happen. The smaller, scrappier conferences will take much longer to come back, just as the neighborhood eateries and restaurants we know and love.

Conclusion

We’ve got to start thinking beyond our previous careers if we are going to achieve the goals of a conference, which is to spread and efficiently disseminate knowledge.